Investors

• Emotion is the greatest destroyer of capital.

• Swiss systems enforce discipline through structure.

• Calm decision-making compounds over decades.

Most investors believe they lose because markets fall. The truth is far less comfortable: most investors lose because they react.

Fear during drawdowns. Greed during rallies. Overconfidence after success. Paralysis after losses. These behavioral patterns repeat endlessly, regardless of intelligence or experience. Markets simply expose them.

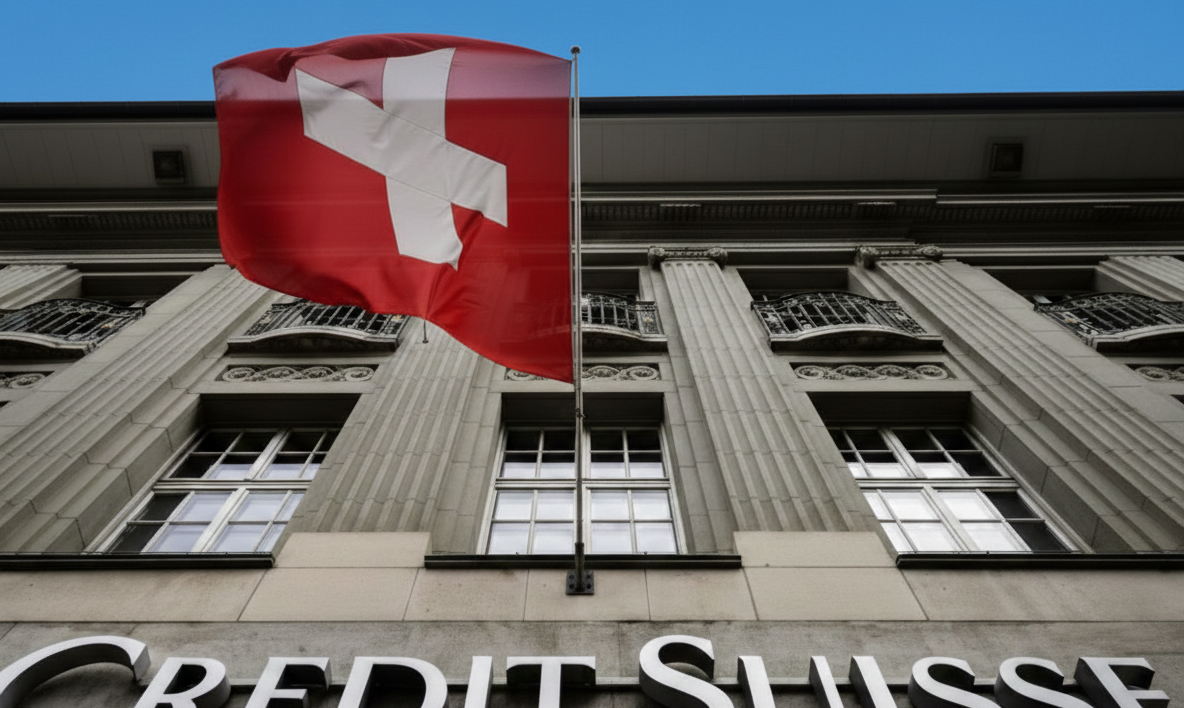

Swiss banking is designed around this reality.

It does not assume rational behavior. It assumes emotional vulnerability — and builds systems to neutralize it.

Swiss banking environments impose discipline without relying on willpower. Governance frameworks, conservative oversight, and clearly defined mandates act as guardrails for behavior.

This is critical.

When decision-making is left entirely to emotion, even sophisticated investors fall into cycles of overtrading, poor timing, and regret. Swiss banking replaces discretionary chaos with institutional order.

Decisions are slower. More deliberate. Less reactive.

That is not a weakness. It is an advantage.

Modern financial media thrives on urgency. Every market move is framed as critical. Every headline demands action. This environment is toxic for capital.

Swiss banking intentionally removes noise.

Reporting is structured. Communication is measured. Short-term volatility is contextualized rather than dramatized. This changes how investors perceive risk.

When noise disappears, clarity emerges.

Investors stop asking “What should I do today?” and start asking “Is my structure still aligned with my objectives?”

That shift alone transforms outcomes.

Calm is not passive. Calm is strategic.

Investors who remain calm during volatility stay invested. They rebalance instead of exiting. They add exposure when others are forced to reduce it.

Over time, this behavior compounds.

Swiss banking institutionalizes calm by reducing the triggers that cause panic. There are fewer surprises. Fewer sudden rule changes. Fewer moments that demand immediate action.

Capital is allowed to work uninterrupted.

Emotional neutrality may be the most underappreciated asset in wealth management.

It allows investors to:

• Maintain exposure during drawdowns

• Avoid chasing late-stage rallies

• Preserve liquidity for real opportunities

• Think in decades instead of days

Swiss banking does not promise excitement. It promises emotional stability.

That stability is what allows compounding to function.

The longer the investment horizon, the more destructive emotional mistakes become. A single panic-driven decision can erase years of disciplined growth.

Swiss banking reduces the probability of that mistake.

It does not eliminate human emotion. It builds systems that prevent emotion from controlling outcomes.

Markets are unpredictable.

Human behavior is predictably flawed.

Swiss banking works because it removes emotion from the driver’s seat — and replaces it with structure.

Previous Post

Previous Post

SKN | Swiss Banking as the Ultimate Status Signal in Global Finance

Next Post

Next Post

SKN | Swiss Banking Works Because It Is Not for Everyone

February 5, 2026

February 5, 2026

February 4, 2026

February 4, 2026